indiana excise tax deduction

26 rows Residential Property Tax Deduction. Indiana has an adjusted gross income flat tax rate of 323.

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

When you buy a car you have to pay Indiana sales tax on the purchase plus excise tax to register the vehicle.

. The Indiana state registration fee and the auto sales tax itself is not deductible but all or a portion of the excise taxes you pay may be deductible on Form 1040 Schedule A. Indiana flat tax rate for 2021 remains at 323 for adjusted gross income. For example some states refer to certain vehicle.

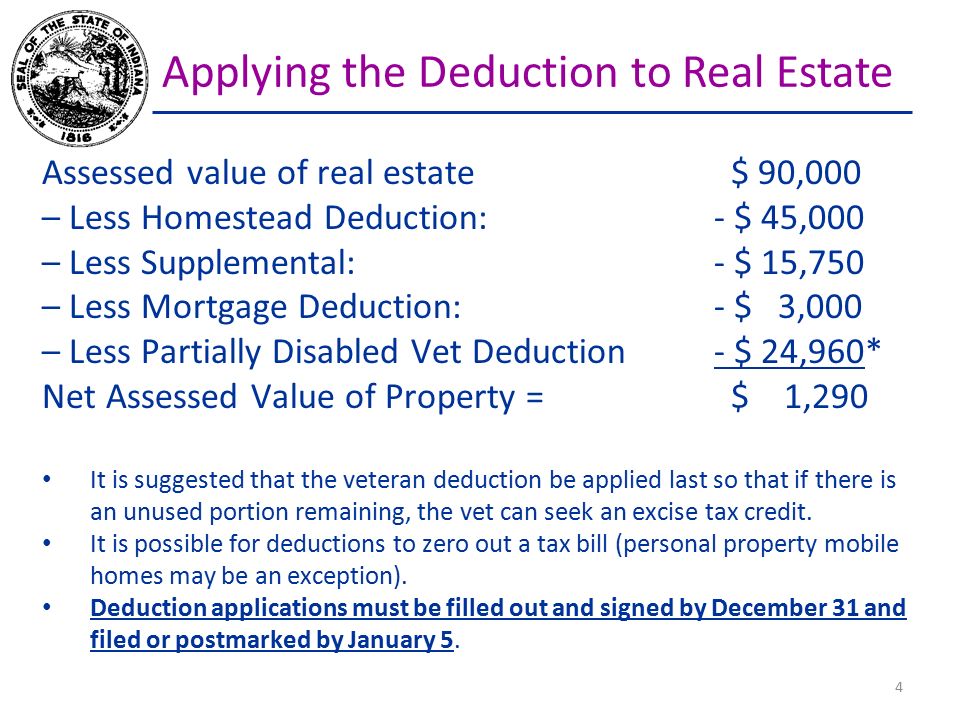

The tax rate is set by. But this amount is actually called an excise tax and not a property tax. Tax with no veterans deduction.

The aircraft license excise tax is imposed on all aircrafts due at the time of registration and is determined by weight age and type of aircraft. Taxpayers are eligible to take a deduction of up to 2500 for Indiana property taxes paid during a tax year on the individuals principal place of. The IRS only allows that portion of a.

The application must be refiled every even year unless. 1 the exempt property is owned occupied and used for educational literary scientific religious or charitable purposes. Retired Indiana veterans or surviving spouse get an adjusted gross income tax deduction totaling 6250 plus.

Retired Indiana Veteran Income Tax Deduction. Below is an example of taxes payable in 2021 for a homestead assessed at 130000 in the city of Portage with and without the veterans deductions. A portion of Indianas vehicle registration fees are tax deductible.

For more information on the new excise tax credit contact the Allen County Auditors office by email acauditorallencountyus or by telephone at 260 449-7241. Indiana Tax Brackets for Tax Year 2020. Any unused portion after applicationto residence property applies next.

What is excise tax on a car in Indiana. The state charges a 7 sales. However some states and localities erroneously label excise taxes as personal property taxes which may be deductible.

DEDUCTION Indiana Code MAXIMUM AMOUNT ELIGIBILITY REQUIREMENTS. My Indiana vehicle registration form shows an excise tax a county wheelsurcharge and a state registration fee.

How Do State And Local Sales Taxes Work Tax Policy Center

New Analysis A Third Of Nc Taxpayers Won T Benefit From Proposed Tax Refund Plan Itep

1952 Indiana Department Of State Revenue Gross Income Tax Bonus Tax Forms 1040 Ebay

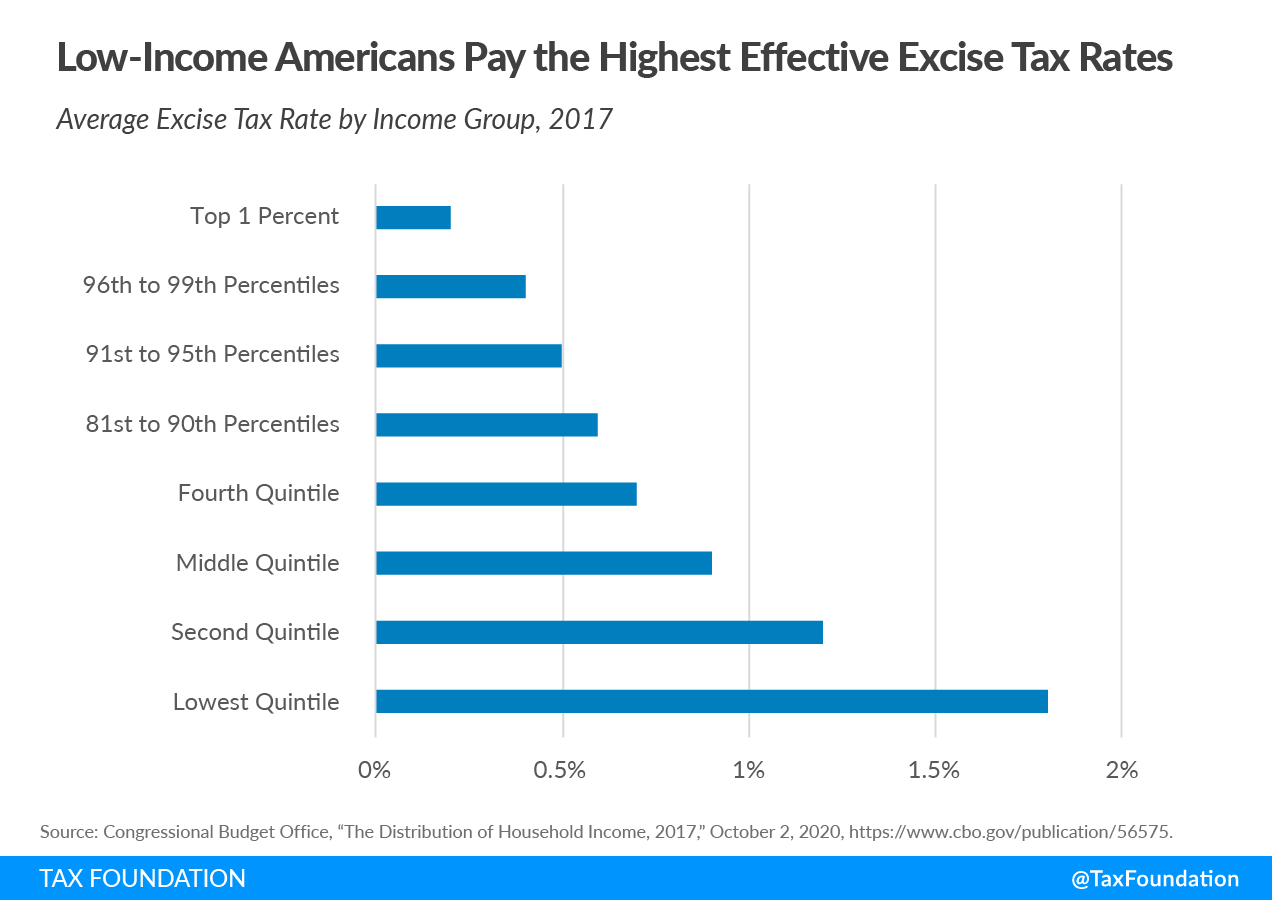

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

Indirect Tax Kpmg United States

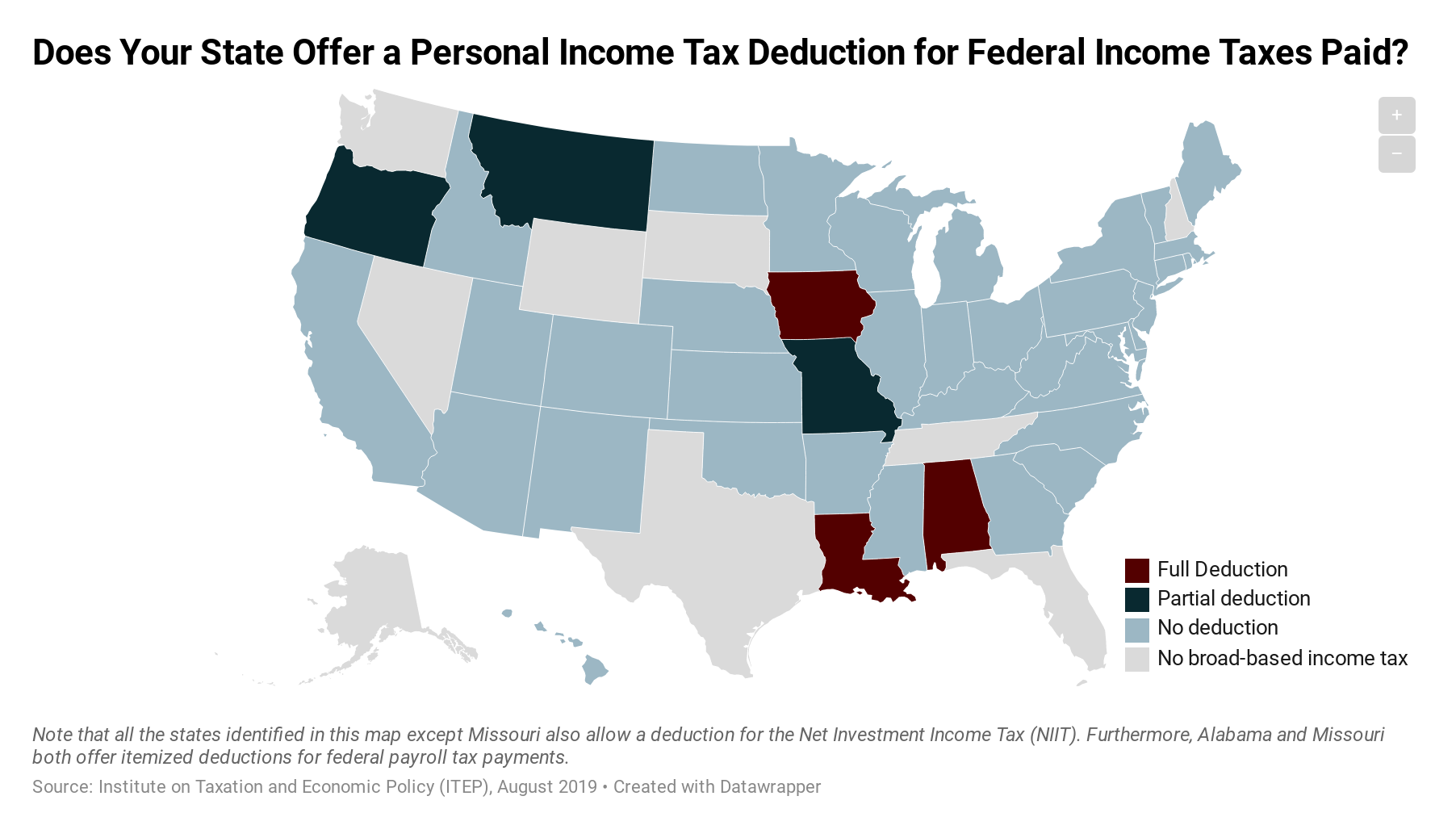

Which States Allow Deductions For Federal Income Taxes Paid Itep

Indiana Sales Tax On Cars What Should I Pay Indy Auto Man Indianapolis

What Part Of My Indiana Vehicle Registration Fee Is Tax Deductible Sapling

Excise Tax In The United States Wikiwand

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

Fall Into Deductions Assessors Conference Mike Duffy General Counsel August Ppt Download

What Part Of My Indiana Vehicle Registration Fee Is Tax Deductible Sapling

State And Local Tax Advisor May 2022 Our Insights Plante Moran

Massachusetts Indiana Utility Receipts Tax Not Required To Be Added Back In Computing Massachusetts Corporate Excise

Other Tobacco Product Distributors Excise Tax Return Opt M Indiana